Table of Contents

FICO matters! 3 digits may be all that is stopping from buying a home

Credit score matters? Three digits _ _ _ (580). They may be all that is standing between you and your dream home, dream car, dreamboat, dream life!

What is a good FICO score to buy a house?

The difficult road to handle your credit score, it’s not that difficult at all, so how your FICO® Score is affecting you?

As you know there are three major credit reporting agencies Equifax, TransUnion®, and Experian®, they collect information about you that ends with Fair Isaac Corporation a data analytics company based in San Jose, California focused on credit scoring services. It was founded by Bill Fair and Earl Isaac in 1956.

Most lenders rely on your FICO score to determine your credit risk and how much they will charge you for the money you borrow.

FICO Scores can range from a low of 300 to a high of 850.

According to FICO, about 1.4 percent of Americans with credit scores have a perfect 850. Credit scores can have a huge impact on a person’s financial life.

Since technology is on everybody hands, a bunch of apps is offering to keep a track of your Vantage Score that it is a different scoring model than FICO, but is still a good way to gauge your credit standing, just keep in mind that your score through these apps might not be entirely accurate.

So, what’s the magic number you’ll need to buy a house? It depends on the type of loan you’ll be pursuing.

FHA (Federal Housing Administration) +580 and above to qualify for the 3.5 percent down payment and +500 and above with a 10 percent down payment.

Veterans Administration (VA) The VA doesn’t loan money so it doesn’t mandate a minimum credit score. Most VA lenders want to see at least a +620 score, although some lenders may approve a borrower with a +580 score. Rural Development (USDA) +640 and above.

Conventional loans 620 and above, as you know your credit score will determine the interest rate on your loan.

Home insurance rates are higher for those with poor credit, people with poor credit, pay at least twice as much as people with excellent credit. The Federal Trade Commission recommends that you order these reports from annualcreditreport.com

You have many options to get your FICO, since data safety is important keep in mind that this is the only agency authorized by the U.S. government.

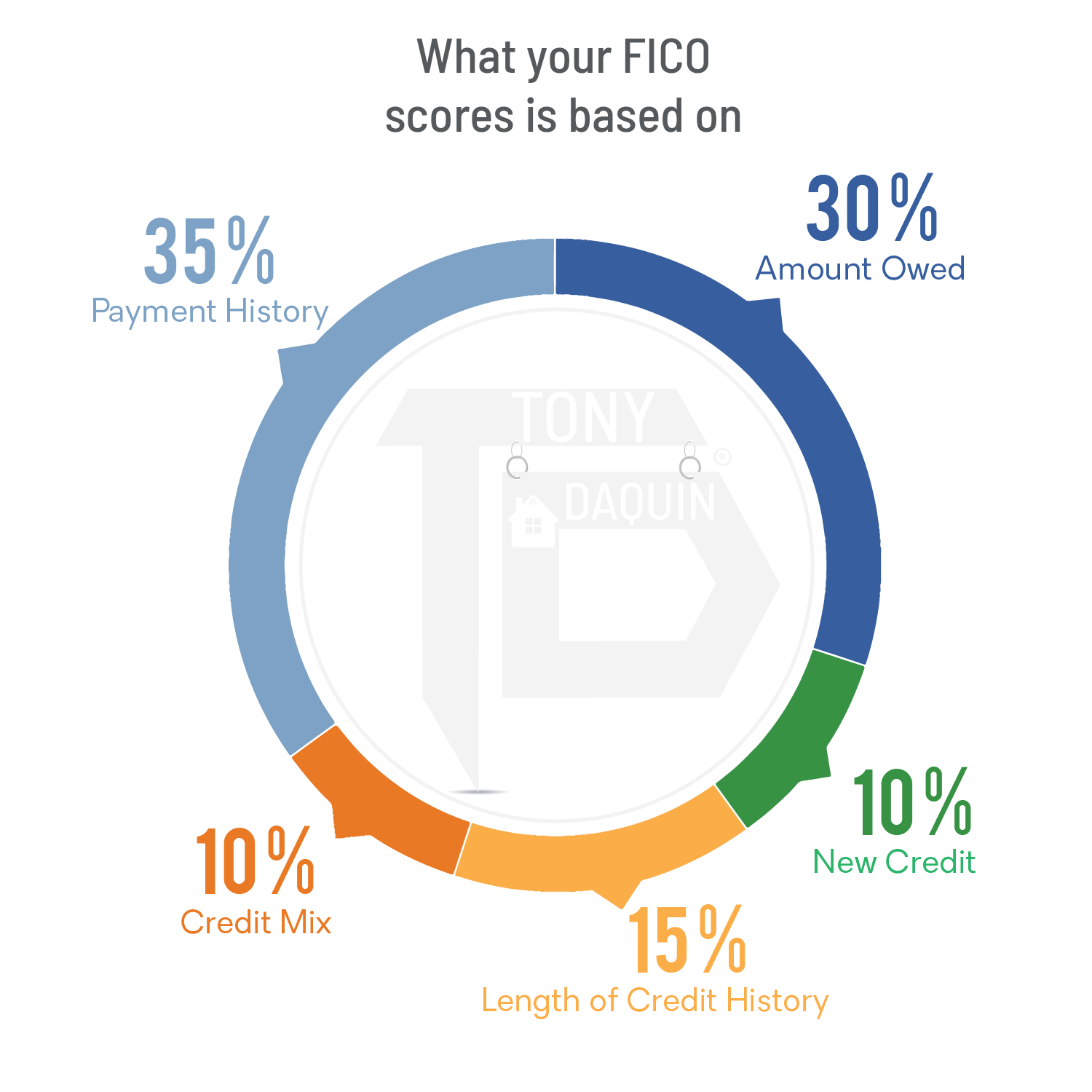

Since your payment history accounts for 35 percent of your credit score, late payments are brutal on your credit score. In the meantime, don’t open any new credit accounts.

Since the credit bureaus don’t know how you’ll use this credit, they consider you a higher credit risk with many credit cards, many analysts advised keeping no more than two or three credit cards, since they will improve your score.

Don’t be shy about obtaining financial counseling. You’ll find a list of approved credit counseling agencies on the Department of Justice website.

Also, you can consider asking for advice from a non-profit housing counselor. You’ll find a list of U.S. Department of Housing and Urban Development-approved counselors online at consumerfinance.gov